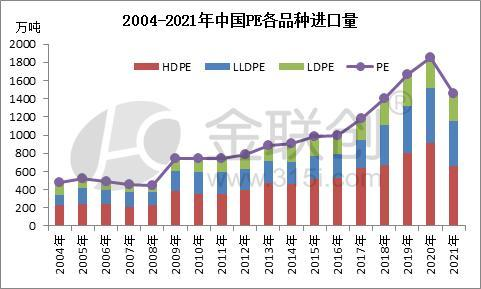

Is féidir an t-athrú ar mhéid allmhairí na Síne ó 2004-2021 a fheiceáil i gceithre chéim de threocht mhéid allmhairí PE na Síne ó 2004, mar a mhionsonraítear thíos.

Is é an chéad chéim ná 2004-2007, nuair a bhí éileamh íseal ar phlaistigh sa tSín agus nuair a choinnigh méid allmhairithe PE leibhéal íseal oibríochta, agus bhí méid allmhairithe PE na Síne íseal in 2008 nuair a bhí suiteálacha nua intíre níos comhchruinnithe agus nuair a d’fhulaing siad géarchéim airgeadais thromchúiseach.

Is é an dara céim ná 2009-2016, chuaigh allmhairí PE na Síne isteach i gcéim fáis chobhsaí tar éis méadú suntasach. I 2009, mar gheall ar tharrtháil caipitil intíre agus eachtrannach, leachtacht dhomhanda, mhéadaigh méid na trádála ginearálta intíre, bhí an t-éileamh amhantrach te, mhéadaigh allmhairí go suntasach, le ráta fáis 64.78%, agus ina dhiaidh sin athchóiriú an ráta malairte in 2010, lean ráta malairte RMB ag méadú, mar aon le teacht i bhfeidhm an chomhaontaithe chreata Limistéar Saorthrádála ASEAN agus laghdaíodh costas na n-allmhairí, mar sin d'fhan méid na n-allmhairí ard ó 2010 go 2013 agus choinnigh an ráta fáis treocht ard. Faoi 2014, mhéadaigh an cumas táirgthe PE intíre nua go suntasach, agus mhéadaigh táirgeadh ábhar ginearálta intíre go tapa; i 2016, thóg an tIarthar na smachtbhannaí ar an Iaráin go hoifigiúil, agus bhí foinsí Iaránacha níos sásta onnmhairiú go dtí an Eoraip le praghsanna níos airde, agus ag an am sin thit fás méid na n-allmhairí intíre ar ais.

Is í an tríú céim ná 2017-2020, mhéadaigh méid allmhairí PE na Síne go géar arís in 2017, tá acmhainn táirgthe PE intíre agus eachtrannach ag méadú agus tá táirgeadh thar lear níos comhchruinnithe. Tá an tSín, mar thír a thomhlaíonn PE go mór, fós ina honnmhaire thábhachtach maidir le hacmhainn táirgthe domhanda a scaoileadh. Ó 2017 i leith, mhéadaigh fána fáis méid allmhairí PE na Síne go suntasach, agus go dtí 2020, seoladh gléasanna nua scagtha móra agus hidreacarbóin éadroma na Síne. Mar sin féin, ó thaobh an tomhaltais de, tá tionchar níos tromchúisí ag an “eipidéim choróin nua” ar an éileamh thar lear. Cé go bhfuil staid chosc agus rialaithe eipidéime na Síne réasúnta cobhsaí agus go bhfuil an t-éileamh i gceannas ar an téarnamh, tá acmhainní thar lear níos claonta chun soláthar a dhéanamh do mhargadh na Síne ar phraghsanna ísle, mar sin coinníonn méid allmhairí PE na Síne fás meánach go hard, agus in 2020 shroich méid allmhairí PE na Síne 18.53 milliún tonna. Mar sin féin, is iad na tosca tiomána atá taobh thiar de mhéadú méid allmhairí PE ag an gcéim seo ná tomhaltas earraí den chuid is mó seachas an t-éileamh láithreach, agus tá brú iomaíoch ag teacht chun cinn de réir a chéile ó mhargaí intíre agus thar lear araon.

Sa bhliain 2021, chuaigh treocht allmhairithe PE na Síne isteach i gcéim nua, agus de réir staitisticí custaim, beidh méid allmhairithe PE na Síne thart ar 14.59 milliún tonna in 2021, síos 3.93 milliún tonna nó 21.29% ó 2020. Mar gheall ar thionchar na heipidéime domhanda, tá an cumas loingseoireachta idirnáisiúnta daingean, tá méadú suntasach tagtha ar an ráta lastais farraige, agus i dteannta thionchar phraghas inbhéartach poileitiléin laistigh agus lasmuigh den mhargadh, laghdófar méid allmhairithe PE intíre go suntasach in 2021. In 2022, leanfaidh cumas táirgthe na Síne ag leathnú, tá sé fós deacair an fhuinneog eadrána laistigh agus lasmuigh den mhargadh a oscailt, fanfaidh méid allmhairithe PE idirnáisiúnta íseal, agus d'fhéadfadh méid allmhairithe PE na Síne dul isteach sa chainéal anuas sa todhchaí.

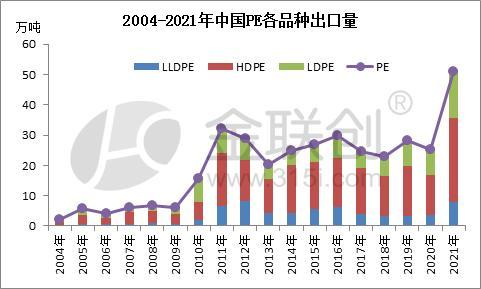

Ó 2004 go 2021, i dtéarmaí onnmhairí PE na Síne de gach speiceas, tá an méid foriomlán allmhairithe PE ón tSín íseal agus tá an aimplitiúid mhór.

Ó 2004 go 2008, bhí méid onnmhairithe PE na Síne laistigh de 100,000 tonna. Tar éis mhí an Mheithimh 2009, ardaíodh an ráta aisíocaíochta cánach onnmhairithe náisiúnta do roinnt plaistigh agus a dtáirgí, amhail polaiméirí eitiléine príomhchruthacha eile, go 13%, agus mhéadaigh díograis onnmhairithe PE intíre.

I 2010-2011, bhí méadú soiléir ar onnmhairiú PE intíre, ach ina dhiaidh sin, tháinig bac arís ar onnmhairiú PE intíre. In ainneoin an mhéadaithe ar chumas táirgthe PE intíre, tá bearna mhór fós i soláthar PE na Síne, agus tá sé deacair méadú mór a bheith ar onnmhairiú bunaithe ar chostas, ar éileamh cáilíochta agus ar shrianta dálaí iompair.

Ó 2011 go 2020, luainigh méid onnmhairithe PE na Síne go cúng, agus bhí a méid onnmhairithe idir 200,000-300,000 tonna den chuid is mó. In 2021, mhéadaigh méid onnmhairithe PE na Síne go mór, agus shroich an t-onnmhairiú bliantúil iomlán 510,000 tonna, méadú 260,000 tonna i gcomparáid le 2020, méadú 104% bliain ar bhliain.

Is é an chúis atá leis sin ná go seolfar gléasraí móra scagtha agus hidreacarbóin éadroma na Síne go lárnach tar éis 2020, agus go scaoilfear an cumas táirgthe go héifeachtach in 2021, agus go méadóidh táirgeadh PE na Síne, go háirithe cineálacha HDPE, le níos mó acmhainní sceidealaithe do ghléasraí nua agus brú iomaíochta méadaithe sa mhargadh. Tá an soláthar ag teannadh, agus tá díol acmhainní PE na Síne go Meiriceá Theas agus áiteanna eile ag méadú.

Is fadhb thromchúiseach í an fás leanúnach ar chumas táirgthe a gcaithfear aghaidh a thabhairt uirthi ar thaobh an tsoláthair de PE na Síne. Faoi láthair, mar gheall ar shrianta costais, éilimh ar cháilíocht agus dálaí iompair, tá sé fós deacair PE intíre a onnmhairiú, ach leis an bhfás leanúnach ar chumas táirgthe intíre, tá sé ríthábhachtach iarracht a dhéanamh díolacháin thar lear a bhaint amach. Tá brú iomaíochta domhanda PE ag éirí níos déine amach anseo, agus ní mór aird bhreise a thabhairt fós ar phatrún an tsoláthair agus an éilimh i margaí intíre agus eachtracha.

Am an phoist: 7 Aibreán 2022